Chapter VI A Deductions: Maximizing Your Tax Savings

Table of Contents

Introduction

Tax deductions can be amongst the most complicated aspects of investing, but learn about Chapter VI A Deductions to get some serious tax relief. The Indian Income Tax Act allows deductions under Chapter VI A of the act which helps taxpayers to bring down their taxable income and, therefore, tax burden. Here this article will discuss the various sections under Chapter VI A, what each pertains to in an unfussy manner bearing reliability and advantages amongst these for your higher benefits.

What is Chapter VI A Deductions?

There are various sections under Chapter VI A of the Income Tax Act that gives many deductions. Most of these deductions are included in Part B of Chapter VI A and they promote savings, investments, along with some types expenditure.

Why Are Chapter VI A Deductions Important?

The aggregate of Chapter VI A deductions can significantly lower your taxable income. Chapter VI A provides strategies for reducing your taxable income by claiming deductions. These deductions can be applied to expenses such as life insurance premiums, education loans, and investments in savings schemes. By utilizing these deductions, you can increase your tax savings.

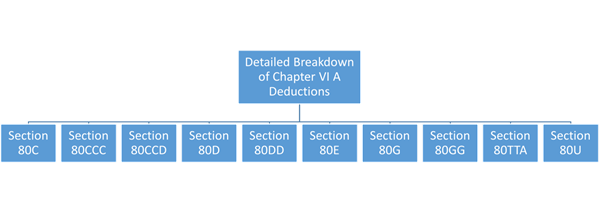

Detailed Breakdown of Chapter VI A Deductions

Section 80C: Deductions on Investments

One of the most commonly used sections under Chapter VI A is Section 80C. It allows deductions for various investments and expenses, with a maximum limit of ₹1,50,000. Here are some popular ways to claim deductions under this section:

Deductions for certain investments and expenses allow you to reduce your taxable income.

For example:

- Life Insurance Premiums: You can claim deductions on premiums paid for life insurance policies up to ₹1,50,000.

- Public Provident Fund (PPF): Contributions made to a PPF account are eligible for deductions, up to ₹1,50,000.

- National Savings Certificates (NSC): Investments in NSCs qualify for deductions also up to ₹1,50,000.

- Tuition Fees: Payments made for your children’s education tuition fees can be claimed as deductions up to ₹1,50,000.

Section 80CCC: Pension Funds

Section 80CCC covers contributions to certain pension funds. The maximum deduction available under this section is ₹1,50,000, which is part of the overall limit under Section 80C.

Section 80CCD: Contributions to Pension Schemes

Section 80CCD is divided into three parts:

- Section 80CCD(1): Company employees are allowed to contribute towards the National Pension Scheme (NPS) or Atal Pension Yojana (APY). The maximum deduction allowed is 10% of the salary structure for salaried employees or 20% of gross total income for self-employed.

- Section 80CCD(1B): Additional deduction up to ₹50,000 for contributions towards NPS.

- Section 80CCD(2): Employer’s contribution to NPS, with a maximum deduction of 10% of salary.

Section 80D: Medical Insurance

Section 80D provides deductions for premiums paid for medical insurance.

Premium Paid for Families:

- Self, spouse, and children: Up to ₹25,000 for maximum deduction.

- Parents (less than 60 years old): Up to ₹25,000.

- Parents (60 years or older): Up to ₹50,000.

Preventive Health Check-up benefits:

Section 80DD: Maintenance of Disabled Dependent

- You can also claim up to ₹5,000 for preventive health check-ups, which comes under the overall deduction limit.

Section 80DD allows deductions for expenses incurred on the medical treatment, training, and rehabilitation of a disabled dependent. The limits are:

- ₹75,000 for normal disability

- ₹1,25,000 for severe disability

Section 80E: Interest on Education Loan

Section 80E benefits in deductions for the interest paid on education loans taken for higher education studies. You can also claim this deduction for up to 8 years or until you fully repay the interest, whichever comes first.

Section 80G: Donations

Section 80G covers donations towards the specified funds and charitable institutions. The deduction amount depends on the type of institution. It can be either half or all of the donation. There are certain specific limits for the deduction amount.

Section 80GG: Rent Paid

Section 80GG allows employees who do not receive HRA from their employer to deduct the house rent they pay.

The deduction is the least of the following:

- ₹5,000 per month

- 25% of total income

- Excess of rent paid over 10% of total income

Section 80TTA: Interest on Savings Account

Section 80TTA provides deductions up to ₹10,000 on the interest earned from savings accounts in banks, post offices, or co-operative societies.

Section 80U: Deduction for Disabled Individuals

Section 80U allows deductions for individuals with disabilities. The limits are:

- ₹75,000 for normal disability

- ₹1,25,000 for severe disability

Maximizing Your Deductions Under Chapter VI A

To maximize your Chapter VI A deductions, it’s essential to understand the limits and conditions of each section. By planning your investments and expenses, you can ensure that you make the most of these provisions.

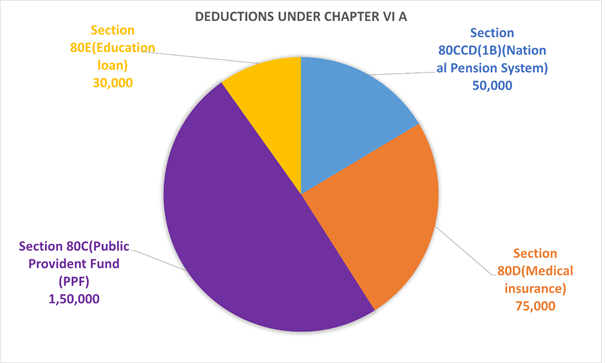

Example Calculation

- Section 80C: You’ve invested ₹1,50,000 in the Public Provident Fund (PPF). This qualifies for a deduction under Section 80C.

- Section 80D: You’ve paid ₹25,000 for yourself and family medical insurance and an additional ₹50,000 for your parent’s medical insurance. The total deduction under Section 80D would be ₹75,000.

- Section 80CCD(1B): You’ve contributed an extra ₹50,000 to the National Pension System (NPS), which is eligible for deduction under this section.

- Section 80E: You’ve paid interest on an education loan up to ₹30,000. This is acceptable for a deduction under Section 80E.

In this scenario, your total deductions under Chapter VI A would be:

- Section 80C: ₹1,50,000

- Section 80D: ₹75,000

- Section 80CCD(1B): ₹50,000

- Section 80E: ₹30,000

Total Deductions Under Chapter VI A: ₹3,05,000

By carefully planning and utilizing the Chapter VI A provisions, you can significantly reduce your taxable income, resulting in considerable tax savings.

Conclusion

Understanding and leveraging Chapter VI A deductions can lead to substantial tax benefits. To make the most of these benefits, learn about the different sections, limits, and eligible expenses. Stay informed about tax laws and consult a tax professional to maximize deductions under Chapter VI A.

Chapter VI A of the Income Tax Act is a very good money habit in which you can reduce your taxes by using it. This can be achieved by saving, investing and insuring. So, drill into the specifics, be strategic about it and build a super-efficient way to save on taxes.

This complete guide to Chapter VI A deductions will assist you in understanding and applying these tax benefits effectively. By doing so, you can optimize your tax savings and achieve greater financial security.

FAQs on Chapter VI A Deductions

Chapter VI A of the Income Tax Act contains provisions for various deductions that taxpayers can claim to reduce their taxable income.

The maximum deduction depends on the specific sections and limits prescribed under Chapter VI A. For instance, Section 80C has a maximum limit of ₹1,50,000, but additional sections like 80CCD(1B) provide extra benefits.

To get tax deductions in Part B of Chapter VI A, you must invest in specific eligible areas. These areas include life insurance, medical insurance, and pension funds. These investments must be mentioned in the specified sections.

Yes, you can claim deductions for both Section 80C and 80CCD(1B). The additional ₹50,000 deduction under 80CCD(1B) is over and above the ₹1,50,000 limit of Section 80C.

The aggregate of Chapter VI A deductions refers to the total deductions claimed under various sections within Chapter VI A, which helps in reducing the overall taxable income.